How to Improve Your Credit Score? and what is a good credit score?

8 Smart Strategies to Improve Your Credit Score is a gradual process that requires consistent financial discipline and responsible credit management. While it may take some time to see significant improvements,

following these steps can help you improve your credit score:

- Check Your Credit Report: Start by obtaining a copy of your credit report from one of the major credit bureaus (Bajaj Finserv,Paisa Bazaar ,cibil) Review it carefully for any errors or inaccuracies that could be negatively impacting your score. If you find any discrepancies, report them to the respective credit bureau for correction.

- Pay Your Bills on Time: Paying your bills on time is vital for maintaining a good credit score. Your payment history plays a crucial role in determining your creditworthiness. Ensure that you make timely payments for all your financial obligations, including credit cards, loans, and utilities. Late payments can significantly harm your credit score. To help you stay on top of your payments, consider setting up automatic payments or using reminders as effective tools.

- Reduce Your Debt: High outstanding debt can negatively affect your credit score.It’s important to prioritize debt repayment, beginning with high-interest debts. By focusing on paying off debts with higher interest rates first, you can save money on interest charges. Additionally, aim to maintain low credit card balances, ideally below 30% of your credit limit. This showcases responsible credit utilization, which positively affects your credit score.

- Avoid Opening Unnecessary Credit Accounts: While it’s good to have a mix of credit types (e.g., credit cards, loans, etc.), It is advisable to refrain from opening numerous new credit accounts in a short span of time. Each time you apply for new credit, it generates a hard inquiry on your credit report, which can temporarily lower your score. Only apply for new credit when necessary.

- Maintain Old Accounts: Closing old credit accounts may seem like a good idea, but it can actually hurt your credit score. The length of your credit history is an important factor. Keeping old accounts open, even if they’re not actively used, shows a longer credit history, which can be beneficial.

- Be Cautious with Credit Applications: Be selective when applying for new credit. Multiple credit applications within a short period can make you appear desperate for credit and may negatively impact your score. Instead, research and apply for credit only when you’re confident you meet the requirements.

- Diversify Your Credit Mix: Having a diverse mix of credit accounts, such as credit cards, installment loans, and mortgages, can positively impact your credit score. However, don’t take on new credit just for the sake of diversification. Only open new accounts if they align with your financial goals and you can manage them responsibly.

- Be Patient and Persistent: Building a good credit score takes time. Be patient and stay committed to practicing responsible financial habits. Consistently paying your bills on time, reducing your debt, and maintaining good credit habits will gradually improve your credit score over time.

Remember that improving your credit score is a long-term process, and there are no quick fixes. It requires discipline, patience, and responsible financial management. By following these steps consistently, you can take control of your credit and work towards achieving a better credit score.

What is a Credit Score and Why is It So Important?

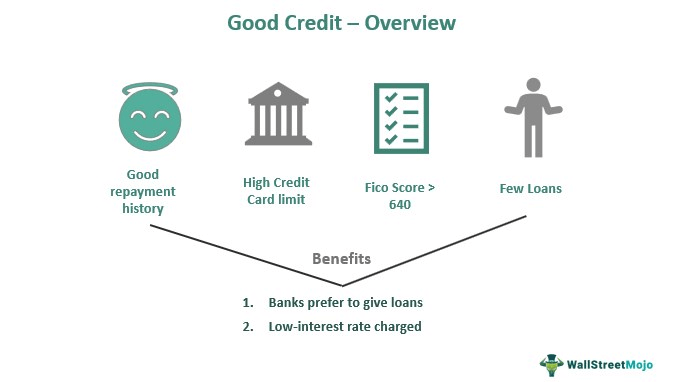

A credit score denotes a numeric portrayal of a person’s creditworthiness. It is a measure of their financial reliability and indicates the likelihood that they will repay borrowed money on time. Credit scores are primarily used by lenders, such as banks and credit card companies, to assess the risk involved in lending money to someone. Credit scores are calculated based on various factors, including payment history, amounts owed, length of credit history, new credit inquiries, and types of credit used. The FICO score stands as the most commonly utilized credit scoring model, encompassing a range between 300 and 850. As the score ascends, the individual’s creditworthiness improves correspondingly.

Credit scores are calculated based on various factors, including payment history, amounts owed, length of credit history, new credit inquiries, and types of credit used. The FICO score stands as the most commonly utilized credit scoring model, encompassing a range between 300 and 850. As the score ascends, the individual’s creditworthiness improves correspondingly.

Credit scores are crucial because they play a significant role in determining whether an individual can obtain credit and what terms they may receive. A high credit score demonstrates responsible financial behavior and makes it easier to secure loans, credit cards, and favorable interest rates. It increases the likelihood of loan approval and may result in better terms, such as lower interest rates and higher credit limits.

On the other hand, a low credit score can limit access to credit or lead to less favorable borrowing terms. Lenders may view individuals with lower scores as higher risk and may be hesitant to extend credit or may charge higher interest rates. Additionally, landlords, insurance companies, and employers may also consider credit scores when making decisions related to renting an apartment, setting insurance premiums, or hiring employees.

Maintaining a good credit score requires responsible financial habits, such as paying bills on time, keeping credit card balances low, and managing debt responsibly. Regularly monitoring one’s credit report and addressing any errors or discrepancies is also important for maintaining an accurate credit score.

In summary, a credit score is a numerical representation of an individual’s creditworthiness, and it is essential because it influences a person’s ability to obtain credit, the terms they receive, and may impact other areas of their financial life. Building and maintaining a good credit score is important for accessing favorable credit opportunities and financial stability.

Advantages of Having a Good Credit Score

Having a good credit score can bring several advantages and benefits to individuals. A credit score is a numerical representation of a person’s creditworthiness and financial responsibility, and it is used by lenders, banks, and other financial institutions to assess the risk associated with lending money or providing credit to someone. Here are some key advantages of having a good credit score:

- Access to Better Interest Rates: A good credit score can make you eligible for lower interest rates on loans and credit cards. Lenders consider borrowers with high credit scores as less risky, so they offer more favorable terms, saving you money on interest payments over time.

- Easier Loan Approval: When you apply for a loan, such as a mortgage, auto loan, or personal loan, having a good credit score increases your chances of getting approved. Lenders are more likely to trust borrowers with a solid credit history, as it indicates responsible financial behavior and a higher likelihood of timely repayment.

- Higher Credit Limits: With a good credit score, you may be granted higher credit limits on your credit cards. This allows you to make larger purchases and provides greater financial flexibility. It also reflects positively on your credit utilization ratio, which is the amount of available credit you’re using compared to your total credit limit.

- Access to Premium Credit Cards: Many credit card companies offer premium cards with exclusive benefits, rewards, and perks to customers with excellent credit scores. These benefits may include cashback, travel rewards, airline miles, and access to airport lounges. Having a good credit score opens doors to these premium offerings.

- Lower Insurance Premiums: Your credit score can also influence your insurance premiums, including auto, home, and rental insurance. Insurers often consider credit scores when determining policy rates, as studies suggest that individuals with higher credit scores are less likely to file insurance claims.

- Utility Connections: When setting up new utility services, such as electricity, water, or cable, utility companies may check your credit score. A good credit score can make it easier to establish new accounts without having to pay a security deposit or provide a cosigner.

- Employment Opportunities: Some employers conduct background checks that include reviewing credit reports as part of their hiring process, particularly for positions that involve handling finances or sensitive information. Having a good credit score can positively impact your chances of being hired for such roles.

- Better Negotiating Power: Whether you’re applying for a loan, negotiating interest rates, or seeking better terms on a lease, a good credit score gives you leverage. Lenders and landlords are more likely to consider your requests and offer more favorable terms when you have a strong credit history.

In summary, a good credit score can provide numerous advantages, including access to lower interest rates, easier loan approval, higher credit limits, premium credit card options, lower insurance premiums, easier utility connections, improved employment prospects, and better negotiating power. It is crucial to maintain a positive credit score by practicing responsible financial habits, such as making timely payments, keeping credit card balances low, and avoiding excessive debt.

Credit Score Ranges and What do They Indicate?

Credit scores are typically represented by a numerical value that reflects an individual’s creditworthiness. Different credit scoring models may have slightly varying ranges, but in general, credit scores fall into specific ranges that indicate the creditworthiness of an individual. Here are the common credit score ranges and what they generally indicate:

- Poor Credit score(300-579): A credit score in this range suggests a high level of risk to lenders. It may be the result of a history of late payments, defaults, or bankruptcy. Individuals with poor credit scores may find it challenging to obtain credit or loans, and if they do, they may face higher interest rates and less favorable terms.

- Fair Credit score (580-669): A fair credit score indicates a moderate level of risk to lenders. It may be associated with a history of occasional late payments or limited credit history. While individuals with fair credit may have access to credit and loans, they might still encounter higher interest rates and less favorable terms compared to those with higher scores.

- Good credit score (670-739): what is a good credit score ? A good credit score implies a lower level of risk to lenders. It suggests responsible credit management and a history of on-time payments. Individuals with good credit scores are more likely to be approved for credit and loans, and they may qualify for competitive interest rates and favorable terms.

- Very Good Credit score(740-799): A very good credit score reflects a lower risk to lenders. It indicates a strong credit history, with a track record of consistent and timely payments. Individuals with very good credit scores have a higher likelihood of obtaining credit and loans with lower interest rates and more favorable terms.

- Excellent Credit score (800-850): An excellent credit score represents the lowest level of risk to lenders. It demonstrates an exceptional credit history, with a long track record of responsible credit management. Individuals with excellent credit scores typically have access to the best interest rates, most favorable terms, and a wide range of credit options.

It’s important to note that these credit score ranges can vary slightly depending on the credit scoring model used. Additionally, lenders may have their own criteria for evaluating creditworthiness beyond just the credit score.

Monitoring and understanding your credit score is crucial for making informed financial decisions. By maintaining a good or excellent credit score, you can enjoy better access to credit, lower interest rates, and more favorable financial opportunities. It’s recommended to regularly check your credit score and take steps to improve it if needed.